About Us

The word ingenium is one of the Latin words at the root of the word engineering and means natural or innate talent.

Our Services

You’ve worked your whole life moving towards retirement. What will retirement look like for you?

Contact Us

Our investment advisors would be happy to answer any questions you have about your financial situation.

Personal Insurance

A foundational piece of your financial life is your personal insurance. Ingenium Financial can provide expert guidance to help you design and implement an insurance plan to meet your unique needs.

Investments

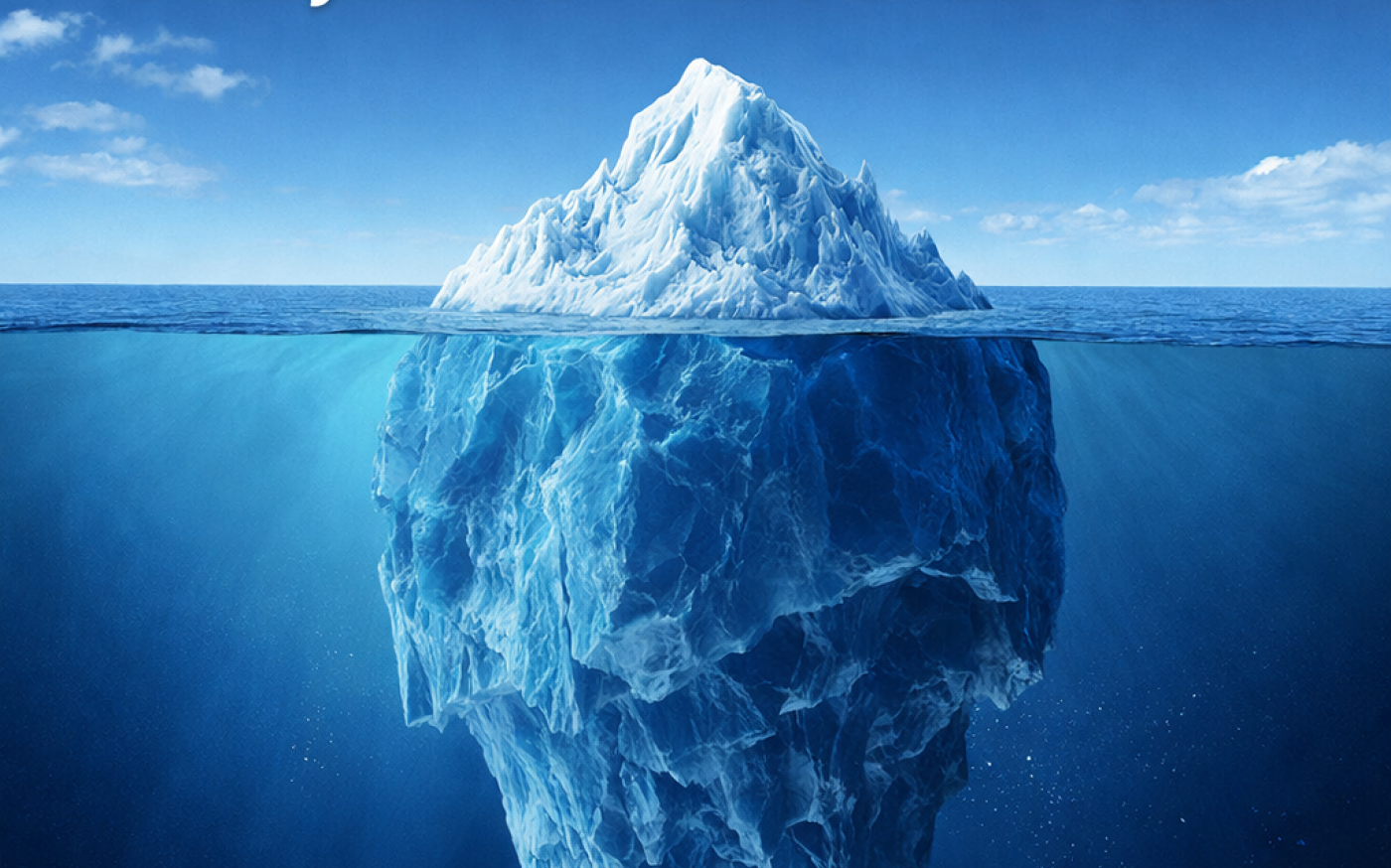

Your investment portfolio is the engine that drives you to your financial goals—retirement, college education, a vacation home, or a bucket-list trip of a lifetime. Just like driving a car, the faster you go, the more risk you’re taking.

Retirement Planning

Planning for your retirement is not an event or a product. It’s a process that should change and adapt as your situation changes. Ingenium Financial can help you create a clear path to your goals—one that makes you feel more secure and prepared for the future.

Estate Planning

With this type of preparation, you can put the tools and processes in place to protect your assets in the event of your incapacitation or death. Ingenium Financial can help you develop a plan to effectively manage your property, now and as it transitions to your heirs.

Business Solutions

As a small business owner, a large part—if not most—of your assets are represented by your business. That means the business is likely providing the income to support your family’s current lifestyle while also funding your retirement.